Are you ready for check truncation? We have been providing Check Processing solution for the past eleven (11) years, with a positive track record that has been measured, tried, tested and proven. We carry inward and outward clearing software developed specifically for Philippine banks. Let us put our knowledge and experience to work for you with our full line of check readers, scanners, and software.

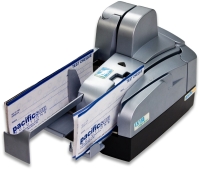

enlarge image

enlarge image

enlarge image

enlarge image

enlarge image

enlarge image

enlarge image

enlarge image

PScan is a check image capturing tool, that was created as a low cost homegrown solution for Check Image Clearing System (CICS).

E-PDC is an inventory system for post-dated checks. Electronic check imaging is a major part of the system, whereby check images and data are captured, stored and retained for a specified period for retrieval and use. With the e-PDC , it's easy to verify if the client's check is post-dated, due or overdue.